Widespread eligibility for the Covid-19 vaccine has made students hopeful about returning to their campuses this fall, but uncertainty about what the future holds has made schools cautious. Will academic life really be “back to normal”? And, after this unprecedented year, what does that even look like?

For marketers, it means having to parse student buying behavior with even fewer points of reference. And while marketing to college students has always had its challenges, marketing to them now requires brands to understand how student behavior has shifted and reshape their strategies accordingly.

To help brands acquire this knowledge, SheerID partnered with Riddle & Bloom in March 2021 to survey 900 college students in the US and Canada, and more than 400 students from France, Germany, and the UK.

Our Back to School Report below presents the survey results, which indicate that despite the challenges of the past year, marketers can effectively engage students if they keep in mind that students:

- Identify with being in school.

- Value their student communities.

- Are motivated by peer recommendations and financial incentives.

- Are spending money, and will continue to do so in the Fall.

The Student Market Potential

College spending was expected to total $67.7 billion in 2020, up from $54.5 billion the previous year and breaking the record of $55.3 billion set in 2018, according to National Retail Federation (NRF) data.

Now more than ever, students want to buy from brands that are student-friendly and give them discounts. Many brands providing student discounts use SheerID’s Verification Platform to verify student eligibility, and in spite of the pandemic, during the 2020-21 school year (through March), those brands used SheerID to collectively verify 11 million students globally. That’s a 21% increase year-over-year, and a number that will likely continue to rise.

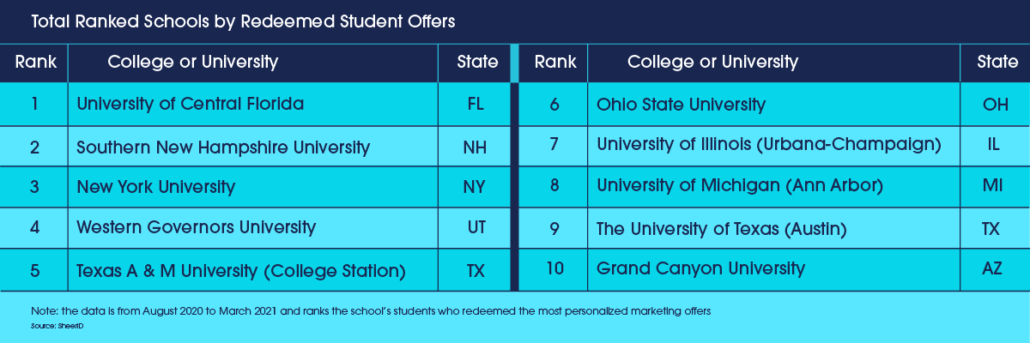

Below are the ten US colleges whose students redeemed the most student offers during this school year (August 2020 to March 2021).

Where are Students Living Now?

Last year, college life was dominated by campuses closing and graduations being cancelled. This year, everyone’s focus has been on how to adapt to the new reality. For students, this first meant deciding where to live when classes resume, and our survey revealed a striking difference between students in the US and EU.

A majority of the students in the US (36%) are currently living off campus near their school, with less than a third living at home with their families and on campus. But in the UK, France, and Germany, a majority of students—more than 40%—live at home with their family. In France, a mere 6% live on campus.

How Are Students Socializing?

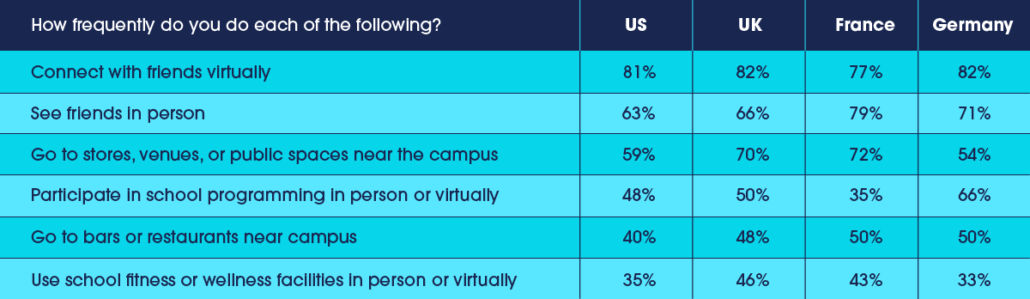

Regardless of where they live, students continue to highly value sharing their college experience with their peers. Across all markets, more than three in four students said they connect with their friends virtually. Many also see their friends in person. In the US, 63% of students said they frequently or occasionally saw friends, and in the EU the percentage of students was even higher (UK – 66%; France – 79%, and Germany – 70%).

While students remained social, when activities involved larger groups or indoor activities, the number of students participating dropped significantly. For example, study groups were kept to once a week for all markets, and most if not all school activities were done virtually.

What COVID-19 Precautions Will Students Take?

Across the board, students agreed the pandemic would affect the Fall 2021 term. More than 8 in 10 students in all markets felt COVID-19 would have an effect (US – 85%, France – 89%, Germany, and the UK – 83%). And while all students planned to alter their behaviors in response to COVID-19, students in the US said they would be the most diligent. Half of US students plan to minimize contact with others, and 60% said they plan to take extra safety precautions. Nearly 50% of US students also said they would minimize contact with others.

What Will Students Do Once Social Restrictions Lift?

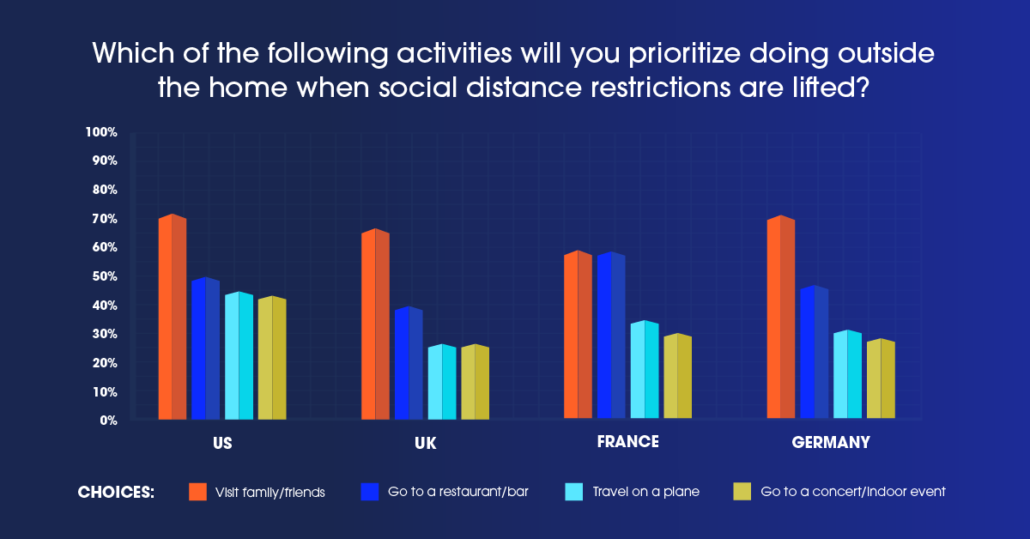

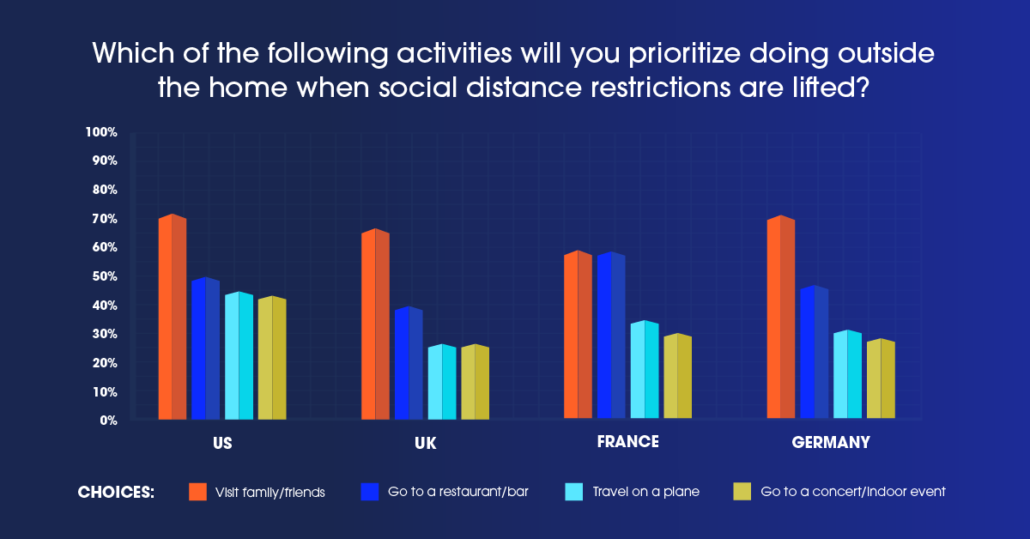

When asked what they would do when social distance guidelines relax, every student’s top choice was to visit family and friends. In the US, more than 7 in 10 students ranked that first. But as the graph below illustrates, many students also plan to go to a restaurant or bar, travel on a plane, and go to a concert or indoor event.

As the percentage of people who have been vaccinated increases, brands who anticipate student participation in these activities will have an advantage over the ones that don’t.

Students Strongly Identify with Their School

Despite the unpredictability of the past year, students remained deeply connected to each other. They expanded their networks, formed online groups, and shored up and reconstituted their communities.

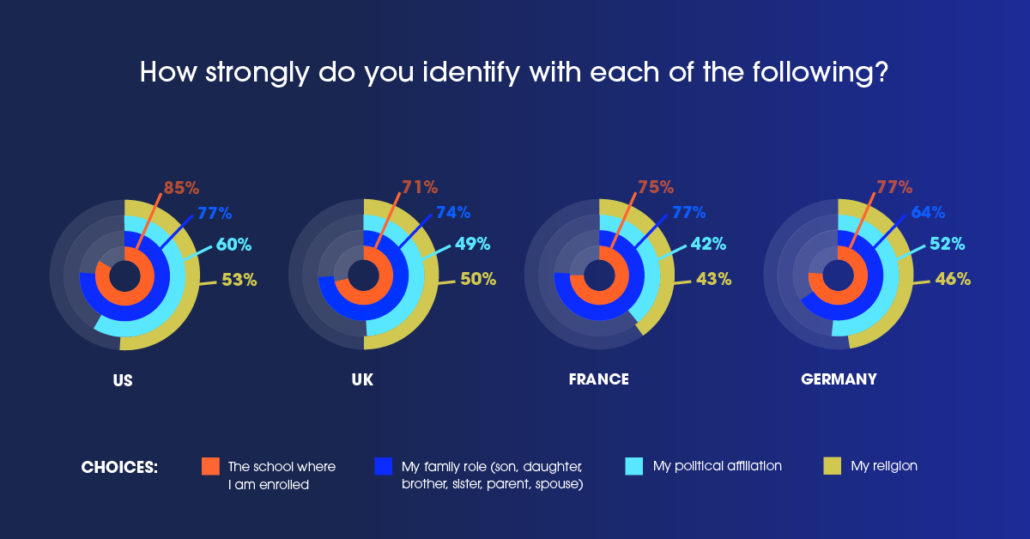

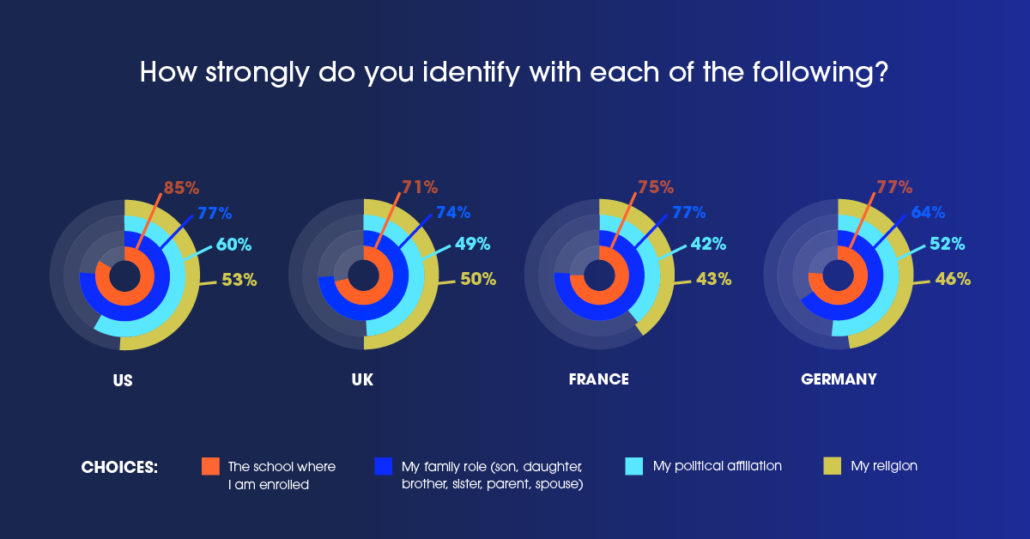

They did this because their college experience is central to how they view themselves and the world. In the US, 85% of students strongly identify with their school. And more than 7 in 10 students in the EU felt the same way.

As the graph below illustrates, many students identify with their school more than they do their family role, and all students identify more with their school than their religion or political affiliation.

Students Are Still Shopping

COVID-19 has brought much uncertainty, but for brands that are marketing to college students, there’s good news: most students are still shopping. Across all markets, no more than 1 in 4 students said COVID-19 would delay their purchase decisions for the Fall 2021 term.

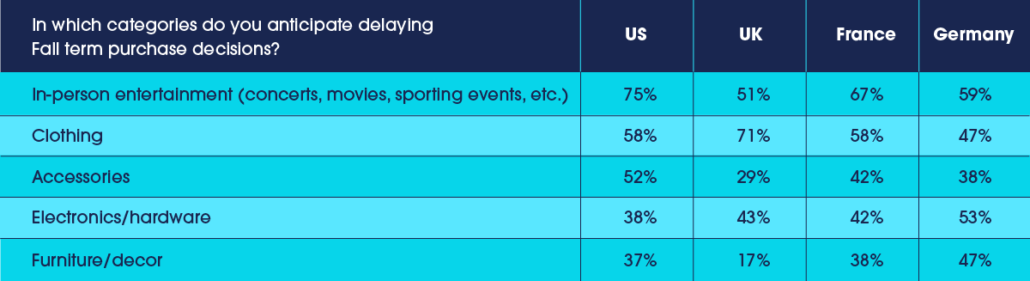

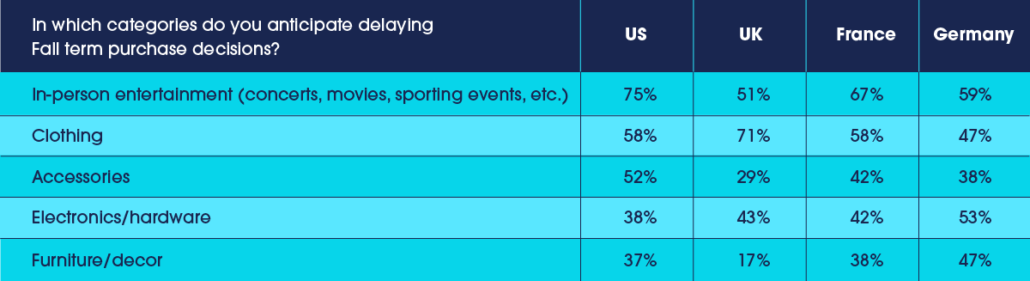

The categories for which students anticipated delaying purchase decisions were in-person entertainment, clothing, and accessories. Delaying in-person entertainment purchases comes as no surprise—who knows if these activities will even take place in the Fall? But some of the same items that students said they would wait to buy are also on their purchase list as they prepare for the fall term.

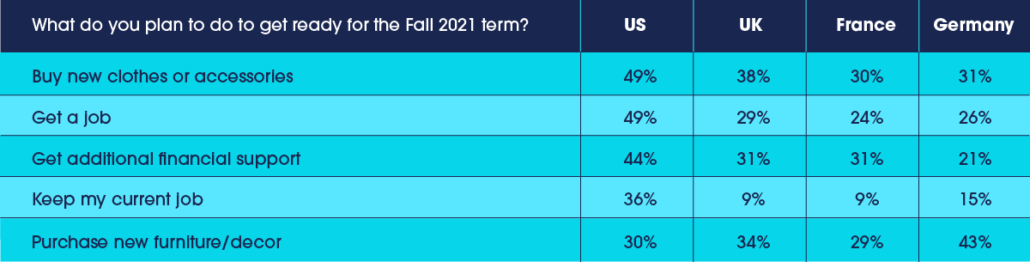

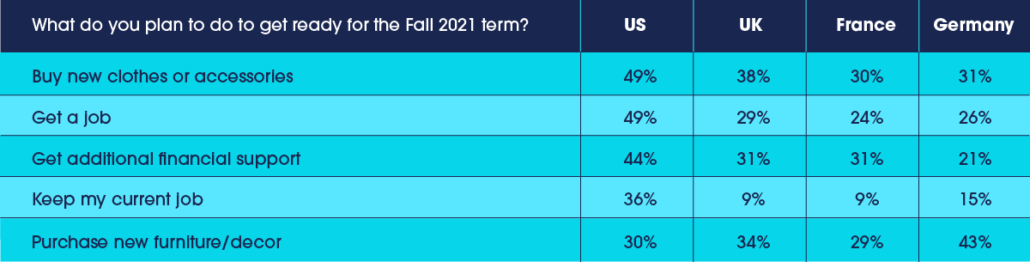

Across all markets, students said they would delay purchasing clothing and accessories, yet those items were also first in the queue to buy for school. US students said getting a job and financial support were also top of mind. Once school is paid for, students said they expected to spend any discretionary money on food and drinks, clothing, and self-care items.

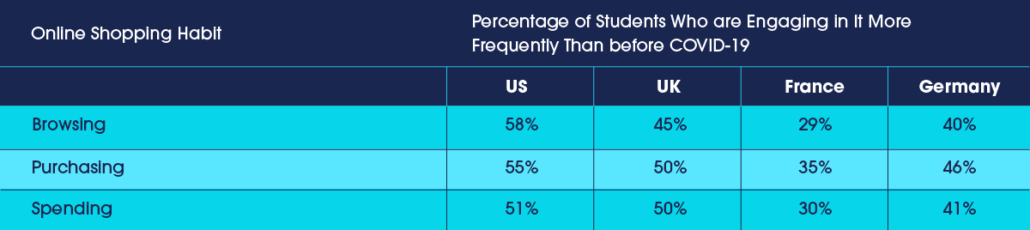

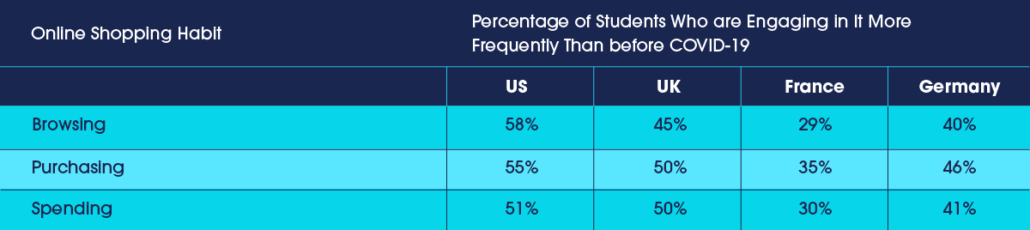

Students are Purchasing More Online

Our survey revealed more good news for brands: students are continuing to search, shop, recommend, and sign-up for new offerings. More than half of US students said they spent more time online and shopping online, and as a result, spent more money online. In the UK, more than half of the respondents said they spent more time online shopping than before, and spent more money online than before.

The takeaway? Brands should be ready to satisfy students’ desire to make purchases as students prepare to return to school.

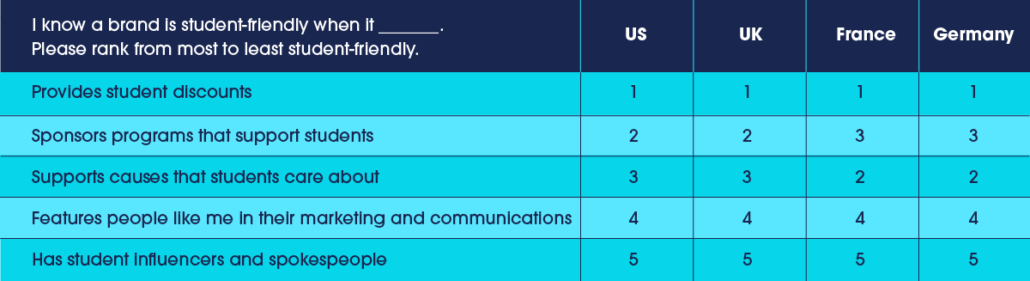

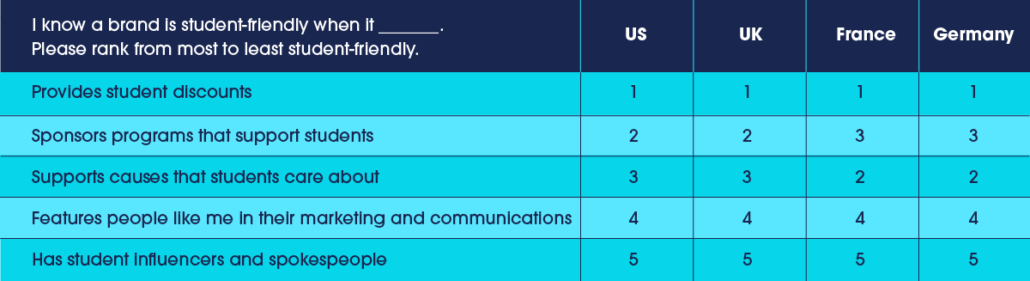

How Brands Can Capture the Attention of Students

The most powerful way to show students you want their business is to offer them a student discount. Across the board, students ranked receiving an exclusive offer the number one way they know a brand is student-friendly.

Running programs that support students and the causes they care about will also help a brand stand out. The least effective approach a brand can take is to hire student influencers and spokespeople—students ranked this tactic last.

Student Discounts Drive Acquisition and Revenue

Students identify strongly with being in college. Brands can win Gen Z’s business by using exclusive offers to reward this aspect of their identity.

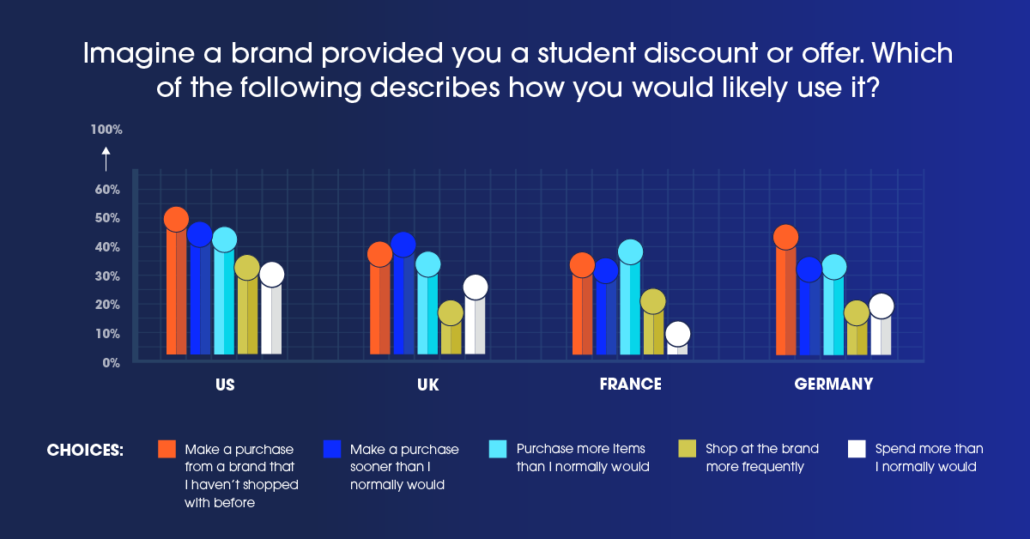

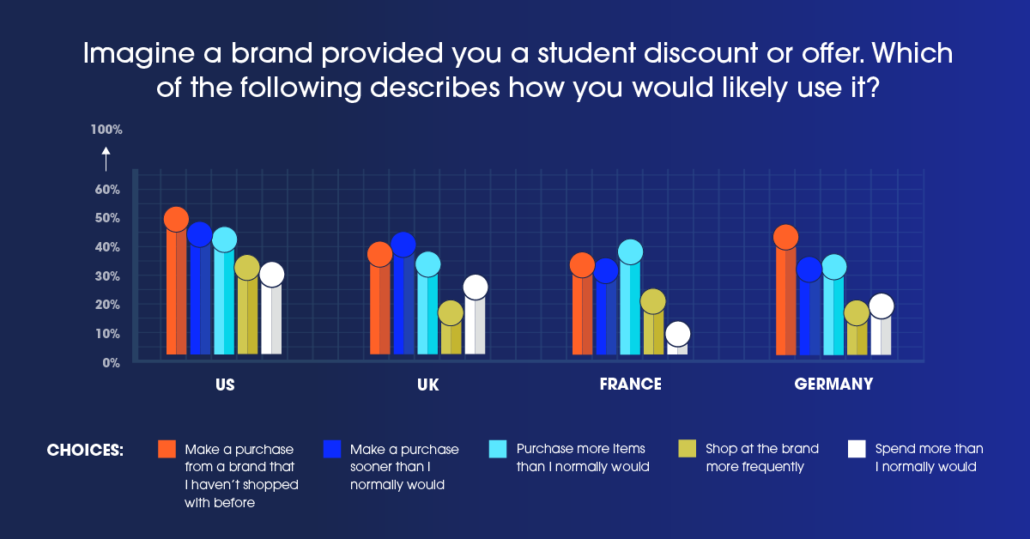

When given a student discount, 54% of students in the US would use it to make a purchase from a brand that they have not shopped with before. In addition, 49% of US students said a student discount would make them purchase sooner, and 47% said it would make them buy more items than they would have otherwise.

What Kind of Promotions Do Students Want?

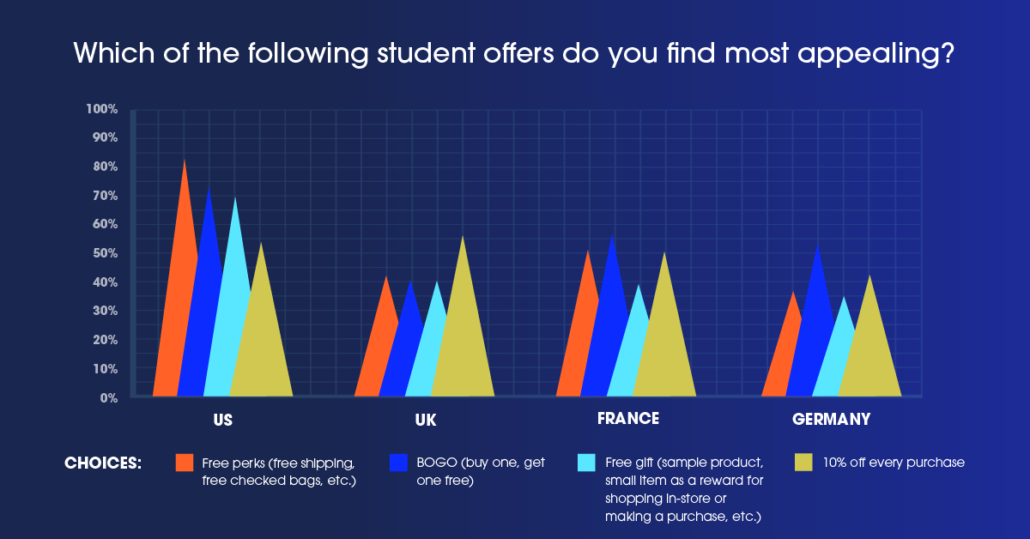

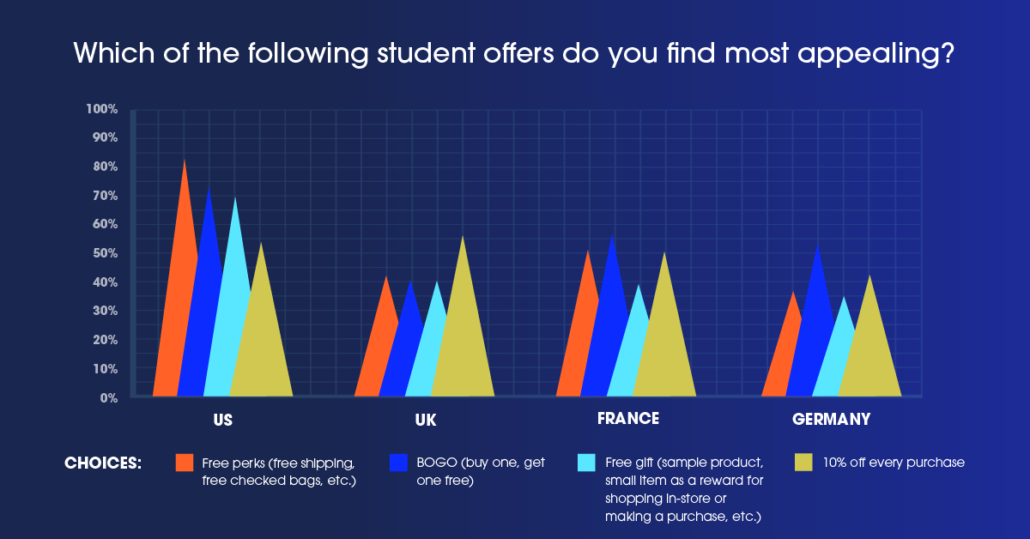

Giving students an exclusive discount is the first step to winning Gen Z. The second is to make sure it’s an attractive offer. Eighty-three percent of students in the US said free perks—such as free shipping or free checked bags—are the most appealing. The second most popular choice for US students was a Buy One, Get One Free (72%), followed by a free gift (71%).

Clearly students like free stuff, and don’t we all? But for college students who are often cash-strapped, small gestures like offering a free perk, additional item, or gift can launch a connection that leads to a lifelong brand relationship.

What Influences Student Buying Behavior?

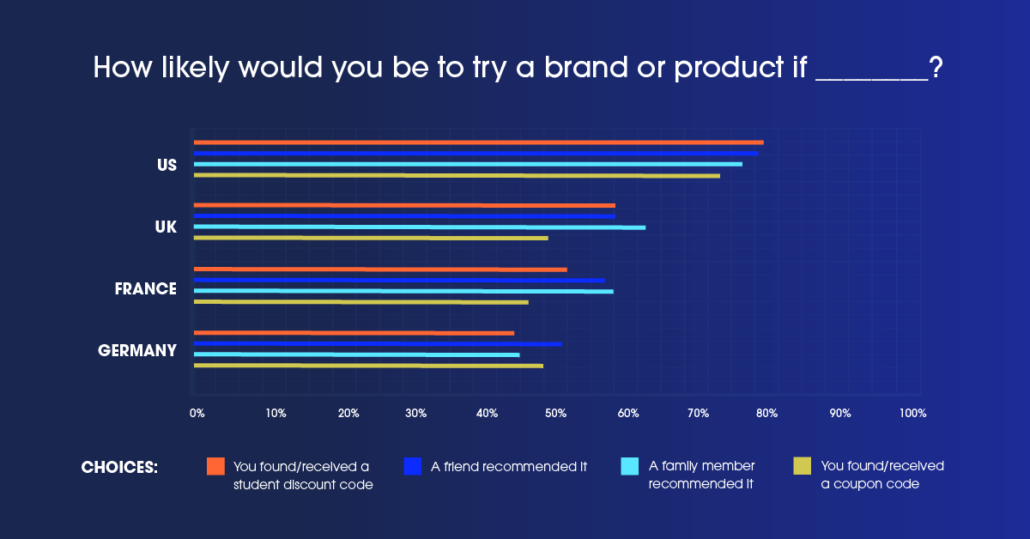

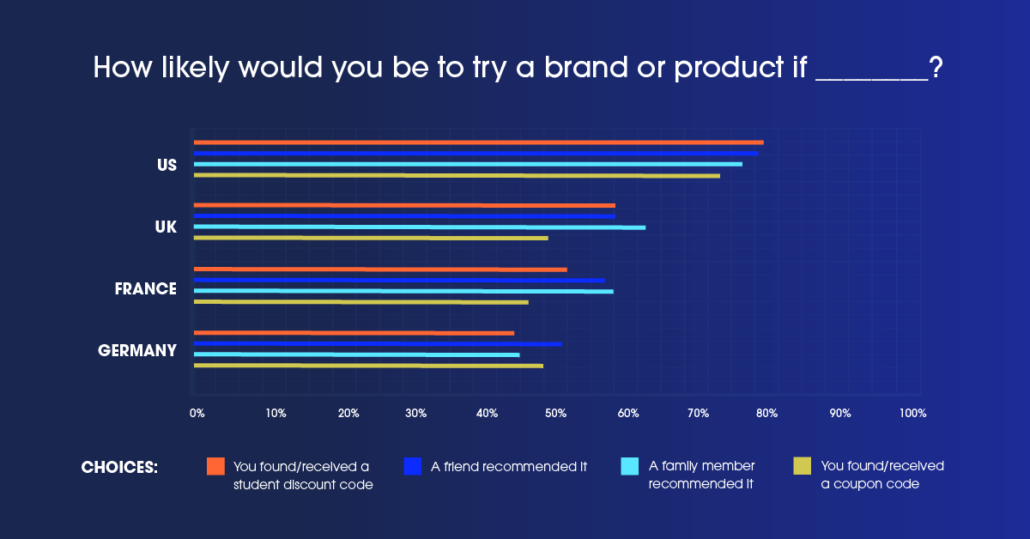

College students are most influenced by their peers and student discount codes. Eighty-two percent of US students said they would likely try a brand or product if they received a student discount code. Seventy-two percent said they would try a brand or product if a friend recommended it, and 78% said they would try a brand or product if a family member recommended it.

While students listen to peers and family, they’re not particularly swayed commercial recommendations. Nearly 40% of college students in the US said they would likely not try a brand or product if recommended by a social influencer—a dynamic that held true in the EU as well.

What Platforms Are Students Using to Share Their Discounts?

Across all markets, Instagram was the platform students said they most use to learn about a student discount or share one with fellow students. In the US, the next most popular ways were to send a text message, tell them in person, or use Snapchat. In the UK and France, Snapchat was students’ second choice, and in Germany Instagram was followed by WhatsApp, and then TikTok.

How Brands Can Optimize Student Offers

Consumers want brand interactions that feel truly tailored to who they are. Gen Zers in particular wants brands to reward their unique identity and align with their values. Creating programs that accomplish this is a great way for brands to capture the attention of Gen Z.

Building these kinds of programs is easy when you follow these four tips to making personalized offer stick for Gen Z:

- Recognize student status.

- Streamline the process and provide immediate gratification.

- Give Gen Z control over their privacy.

- Prioritize mobile engagement.

Brands that have taken this approach and delivered personalized offers to students have won their business and their loyalty. Below are a few stories of their success.

The Key to Acquiring Students

Even amid the upheaval and dislocation of the past year, attending college has given Gen Z consumers a sense of consistency and a community they strongly identify with. As these consumers continue to shop in preparation to return to their schools, marketers who capitalize on this affiliation will garner students’ attention and spend. Doing this requires accessing the audience, delivering relevant and credible messages, and prompting conversions with a compelling personalized offer.

SheerID and Riddle and Bloom recommend that brands:

- Recognize college students’ unique identity. Eighty-five percent of students were adamant that their student status was the best way to get their attention.

- Activate student networks. College students are highly connected and look for recommendations from the people they trust: 81% said they would trust a recommendation from a friend and 78% said they would trust one from a family member.

- Capture student’s attention with a student offer. Giving students a personalized offer is a great way to launch a brand relationship. More than 8 in 10 students said they would try a brand or product if they received a student discount code.

- Monitor the pulse of college student sentiment as the Fall term approaches. Given the dynamic nature of the pandemic and response by local governments, 60% of students said they were planning on taking extra safety precautions in the fall. Keeping abreast of students behavior will ensure you meet them where they are.

By using exclusive offers to recognize students’ strong identification with their school, savvy brands can cut through all the clamor and uncertainty to acquire Gen Z student consumers—right when they are developing brand loyalties and buying habits they will carry into adulthood.